Annual Mortgage Insurance Premium (MIP)

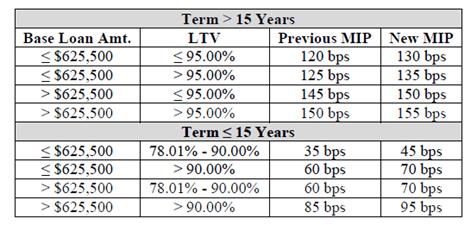

The chart shown describes the MIP structure, which varies based on base loan amount and loan-to-value (LTV).

The chart differentiates loans in three ways: 1) duration of loan (more or less than 15 years), 2) loan amount (more ore less than $625,000), and 3) loan-to-value (LTV: size of the loan against the value of the home).

The column on the far right determines how much you will pay. The term “bps” refers to “basis points.” One “basis point” is equal to 0.01%.

To take the second row as an example:

You have a loan amount less than $625,000 and an LTV more than 95%. Your annual MIP payment will be 1.35% of the loan amount. On a loan of $100,000 for a house worth $100,000, you would pay $1,350 per year in mortgage insurance fees, or $108.3 per month. In this example, the borrower pays an extra $100 per year in mortgage insurance.

Most FHA loans will require a 1.3% or a 1.35% MIP.