Credit Check, Initial Disclosures, & Processed

Once all the paperwork has been gathered and accurately filled out, we will run a credit check, as well as verify that we have all accurate and necessary information to move forward. Then, you’ll be asked to sign the initial disclosures, and the loan is processed through Fannie Mae, Freddie Mac or another government automated underwriting engine (depending on the loan) for official pre approval. Once this occurs, you can lock in your rate and get the terms fixed, or you can float the rate if you think there’s a chance of market improvement, or you’re still uncertain when you want to close.

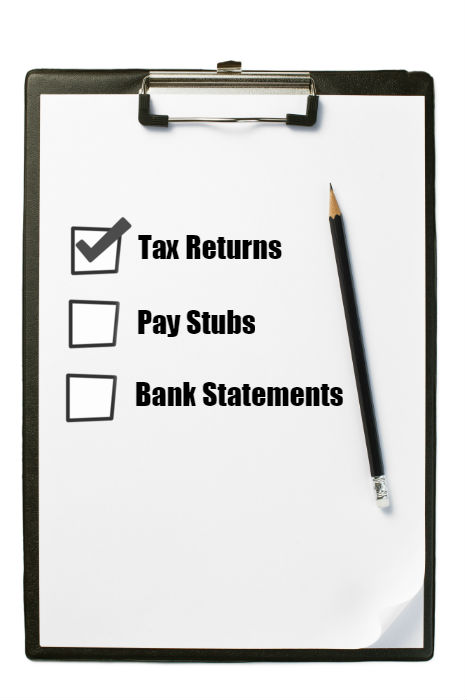

Pre approval can be done in as little as an hour if you have thoroughly completed the loan application and have all the needed paperwork to support the information on the application. Things will take longer if you don’t supply the correct or thorough enough information, or if needed documents are missing. It’s best to stay in communication with your loan officer if you have any questions, so this process can go smoothly.