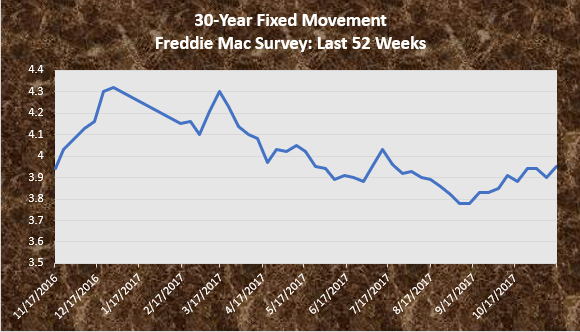

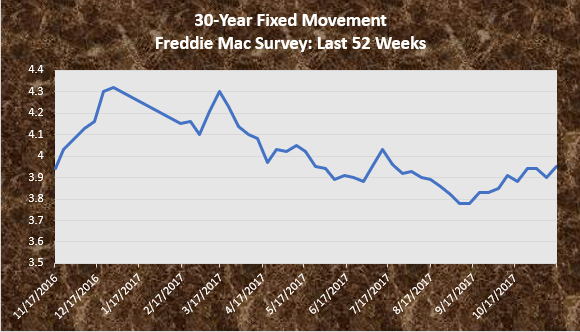

Take a look at the Freddie Mac Survey of the 30-year fixed rate movement over the past year:

The Freddie Mac mortgage rate increased by 5 basis points this week to a level of 3.95%. APR still remains higher than it was a year ago when it was at a level of 3.94%, this is only one basis points lower than the current APR of 3.95%.

Attributed to Sean Becketti, chief economist, Freddie Mac.

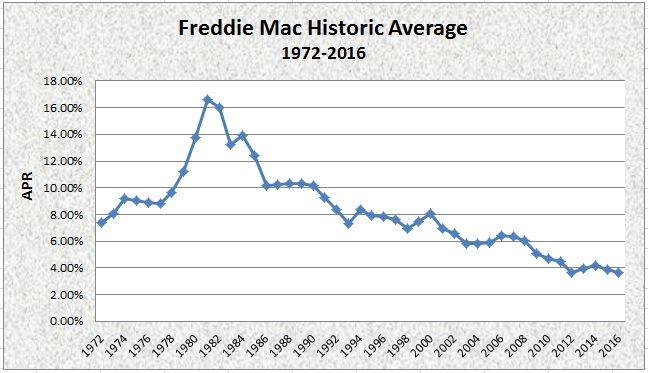

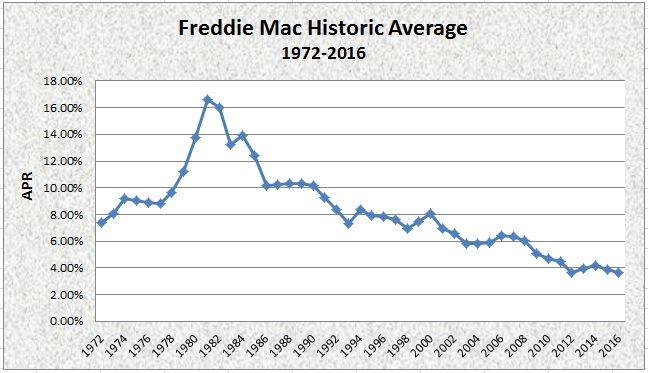

Here is the Freddie Mac Survey of the 30-year fixed historical average rate movement over the past 30 years:

APR rates for the year of 2016 were at historically low levels , with an APR of 3.65% for a 30-year fixed rate mortgage, they were at the lowest we’ve ever seen them. 2012 was the previous low with an APR of 3.66%, only one basis point higher than what we saw in 2016. APR rates dropped 20 points from 3.85% in 2015 to the low of 3.65% in 2016. The highest APR rates were in the early 1980’s when they reached an ultimate high of 16.63% in 1981, almost 5 times more than the APR rates in 2016. Since 2012 rates have remained somewhat flat and comparatively low changing minimally.

Now is the perfect time to contact the Mortgage Experts for your home purchase or refinance! With our 21-Day Processing method, you can make a stronger purchase offer, reduce stress, and save money! Give us a call at 805.543.LOAN to discuss your mortgage options and to get a free rate quote.

The Freddie Mac mortgage rate increased by 5 basis points this week to a level of 3.95%. APR still remains higher than it was a year ago when it was at a level of 3.94%, this is only one basis points lower than the current APR of 3.95%.

The Freddie Mac mortgage rate increased by 5 basis points this week to a level of 3.95%. APR still remains higher than it was a year ago when it was at a level of 3.94%, this is only one basis points lower than the current APR of 3.95%.

APR rates for the year of 2016 were at historically low levels , with an APR of 3.65% for a 30-year fixed rate mortgage, they were at the lowest we’ve ever seen them. 2012 was the previous low with an APR of 3.66%, only one basis point higher than what we saw in 2016. APR rates dropped 20 points from 3.85% in 2015 to the low of 3.65% in 2016. The highest APR rates were in the early 1980’s when they reached an ultimate high of 16.63% in 1981, almost 5 times more than the APR rates in 2016. Since 2012 rates have remained somewhat flat and comparatively low changing minimally.

APR rates for the year of 2016 were at historically low levels , with an APR of 3.65% for a 30-year fixed rate mortgage, they were at the lowest we’ve ever seen them. 2012 was the previous low with an APR of 3.66%, only one basis point higher than what we saw in 2016. APR rates dropped 20 points from 3.85% in 2015 to the low of 3.65% in 2016. The highest APR rates were in the early 1980’s when they reached an ultimate high of 16.63% in 1981, almost 5 times more than the APR rates in 2016. Since 2012 rates have remained somewhat flat and comparatively low changing minimally.