15 Aug Senior Loan Officer Survey, Job Openings, Consumer Credit, Weekly jobless Claims, Producer Price Index, and Consumer price Index & Core CPI

Senior Loan Officer Survey

About 17% of banks have eased standards and terms on business loans to large firms in the second quarter, while more than 10% eased conditions for small firms. For consumers, 6.5% of banks reported they had tightened standards on credit card loans, while standards for residential real estate and auto loans remained unchanged. Bank officers said they were easing standards on business loans because of increased competition from other lenders. They also cited more of a favorable economic outlook with increased tolerance for risk and increased liquidity in the secondary market for these loans as reasons for easing. The fraction of banks saying that their subprime credit card lending standards are at the relatively tighter end of the range since 2005 has increased compared to one year ago.

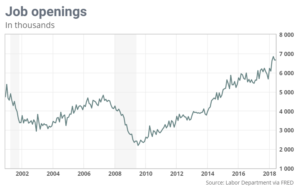

Job Openings

There were 6.66 million job openings at the end of June, up fractionally from May’s levels and the third highest in history dating back to 2000. The quits rate stayed at 2.3% for the fourth month in a row now, this is seen as a proxy for employee willingness to search for a better paying position. Openings increased in educational services but decreased in transportations, warehousing, and utilities. The US jobs market is one of the healthiest its been in years, as seen by high job openings and a 39% unemployment rate. Still, the lack of aggressive wage growth and in fact the steady stream of job growth still suggests there is more slack than typical at this stage of the cycle.

Consumer Credit

Consumer borrowing slowed in June after hitting a six-month high in the prior month. Total consumer credit increased $10.2 billion in June to a seasonally adjusted $3.91 trillion. That is an annual growth rate of 3.1%. Economists had been expecting a $16 billion gain, credit rose $24.3 billion in May. Revolving credit declined by 0.2% in June after an 11.2% gain in May. This is the second drop in credit card use in the past four months. Nonrevolving credit, rose 4.4% in June and has been steadily rising. Consumer spending was strong, rising at a 4% annual rate in the second quarter after a sharp slowdown in the first quarter. With the labor market tight and wages rising, economists are counting on consumers to keep GDP growth near 3% for the remainder of the year. At the same time, consumers use of credit cards has been on a downward trend, banks tightening of standards on credit cards in the second quarter, which may account for some of the slowing trend. In addition., the government revised its GDP data last month to show that Americans are saving more than previously thought. The savings rate was actually twice as high as 2017 at 6.7% than prior estimates. These upward revisions suggest that Americans haven’t been dipping into the savings to fund purchases. Both credit cards and student loans are accelerating just slightly in 2018 following about 3 years of slower growth.

Weekly jobless Claims

Initial jobless claims, a tracker for layoffs in the US, fell by 6,000 to 213,000 in the week ending in August 4th. This was below the 217,000-estimate polled by economists and the first decline in three weeks. The more stable monthly average of claims fell by a smaller 500 claims to 214,250, for the second lowest reading during the nine year expansion that began in mid-2009. The number of people already collecting unemployment benefits or continuing claims rose by 29,000 to 1.76 million, this is almost a quarter of a million lower than this time last year. Claims continue to trend lower, signaling the labor market is strong enough to keep the unemployment rate trending down. The unemployment rate fell to 3.9% in July, a nearly two decade low.

Producer Price Index

The producer price index was flat in July and was below economists’ forecasts of a 0.2% gain. Another measure, economists preferred measure, known as core PPI, rose 0.3% for the second straight month. The core rate strips out food, energy and trade margins. The flat PPI reading pulled the 12-month rate of wholesale inflation down to 3.3% from 3.4%. The 12-month rate of core PPI advanced to 2.8% in July the highest since March.

Consumer price Index & Core CPI

The consumer price index rose 0.2% in July, as rising shelter costs help to offset a decline in energy prices. Economists surveyed had forecasted a 0.2% increase. The increase in the CPI over the past 12 months was 2.9%, unchanged from June. After stripping out volatile gas and food, the more closely followed core rate of inflation rose 0.2% last month. The 12-month rate of core inflation rose to 2.4%, the highest rate since September 2008. Economists prefer the core inflation to consumer price index because it tends to predict future price trends better than the headline number. The rise in the cost of living last month was driven by shelter costs, which rose 0.3% in July and accounted for nearly 60% of the increase to the CPI. The cost of food rose by 0.12%, while energy costs fell by 0.5% last month the gain in the core was led by several categories including shelter, used cars, and trucks, household furnishing and recreation. The indexes for medical care and apparel declined in July. The steady uptick in inflation is taking a bite out of household income. Real or inflation adjusted hourly wages were flat in July, and they were down 0.2% over the past year. Core inflation has been trending higher, but economists see signs that it will begin to moderate in upcoming months. But with prices rising along with the low unemployment rate and strong economy, the Fed is expected to raise interest rates in the September meeting. While used car prices were surprisingly strong and rents keep rising, headline and core inflation will moderate by the end of the year.