01 Oct CCL Market Update: Chicago Fed National Activity Index, Case-Shiller HPI, FHFA House Price Index, Consumer Confidence Index, and More…

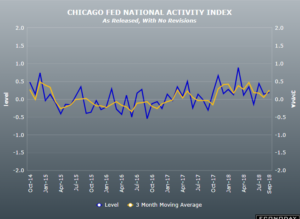

Chicago Fed National Activity Index

The National Activity Index put out by the Chicago Fed, this index tracks overall economic activity as well as inflationary pressures. The Index is a weighted average of 85 existing monthly indicators of national economic activity and inflationary pressures. A positive reading corresponds to growth above trend while a negative reading would indicate growth that is below trend. The National Activity index rose a solid 0.18 points in August to match July’s upwardly revised reading. Of the index’s four main components, productions gave the most lift, as it contributed 0.16 points and led by a nearly five point rise in the Institute of For Supply Managements (ISM) production index. The ISM’s new orders component of the index, which at 65.1 also rose nearly 5 points, this led a 0.07 contribution for the sales, orders, and inventories components. Employment was not a positive in the month, as they pulled the index down 0.01 as employment dropped by 423,000 in the household survey offset by a sharp rise in payroll growth. Personal consumption and housing, the fourth component tracked by the report, also weighted on the index, as it subtracted 0.04, as weakness in spending offset the slight improvement in housing. Despite spots of weakness seen in the report, the three month average is still showing acceleration, at a pace of 0.24 in August vs. its only 0.02 growth rate in July.

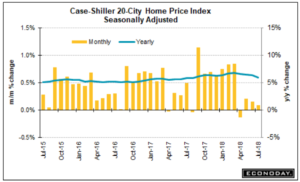

Case-Shiller HPI

Case- Shiller data continues to point to very soft price traction in home prices, inching only 0.1 percent higher for July’s 20-city adjusted index. The unadjusted index rose only 0.3 percent in the month with the year on year rate noticeably weak at a level which is down 5 tenths from June and the lowest rate since last August 2017. The Case-Shiller has missed economists’ predictions for the past four reports in a row as home prices have been slowing sharply. Another month of limited growth is the prediction for Case-Shiller data in the next month. The unadjusted year on year rate is at a consensus of 6.3% and is seen to hold at June’s rate. The consensus for unadjusted monthly growth reflecting the low-price strength in July compared to prior months in the year, calls for a 0.5% growth rate.

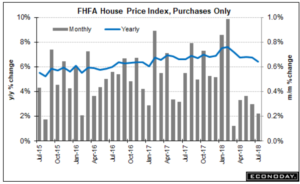

FHFA House Price Index

The FHFA price index, similar to the Case-Shiller index (above), also missed economists’ consensus for the past four months as home price appreciations has gone south in recent months. The FHFA house price index has managed only very small gains the past four reports with a bit better gain of 0.3% in July, meeting economists’ predictions vs. Junes 0.2 percent. Weakness in home prices is becoming a central negative for the 2018 economy. FHFA’s house price index managed only a 0.2 percent gain in July, the weakest gain since March of this year; while the year on year rate is at 6.4% and the weakest since January of last year. Four of the nine regions followed by this report showed monthly declines. The Case-Shiller index also showed similar weakness for the housing sector that appears to be an increasing drag on overall economic growth.

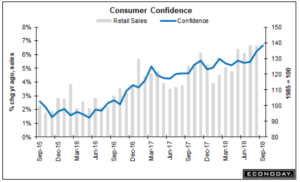

Consumer Confidence Index

In the consumer confidence report, headline strength is spectacular, however, the details are not lifting expectations for the September employment report. Confidence shot up to 138.4 easily surpassing economists’ predictions and setting an 18 year high and now within shot of the all time record of 144.7 hit during the 200’s dotcom era. The other results were not so positive, as the consumer’s assessment of the labor market described jobs as increasingly hard to get as they jumped up a sizable 1.1 percentage point to 13.2%. This reading is very carefully watched by forecasters and is only marginally offset by a 3.4 percentage point rise to 45.7 percent of the labor force saying jobs are currently plentiful., rather than the 13.2% that complain jobs are hard to find. Another positive in the report was strength seen in the assessment of business conditions which helped to lift the present situation component up by 3 tenths to 173.1. The assessment of the future conditions, those workers who see their income improving over the next six months declined by 2.8 points to 22.6 percent which was offset in part by the four tenths decline to a level of 6.5 percent for those who see their income falling. A clear positive were the assessments of the future labor and business conditions which made for a 6.0-point gain in the expectations index to a level of 115.3. Buying plans for autos are strong, up 4 tenths to 13.4 percent, and home buying plans are also positive, up 3 tenths to 6.6 percent in good news for the nation’s Realtor and home builders. Buying plans for major appliances are strong but downs slightly at 52.9. Sentiment in the stock market is on the rise with bulls up 2.7 percentage points to 42.5 percent while bears decreased by 1.3 points to 22.4 percent. On interest rates. 68.2 percent see them moving higher, while only 6.8 percent see them moving lower. This report, though not as strong as it looks at first glance still remains solid, following a mid-month jump in the consumer sentiment index suggesting a pivot higher in consumer spirits this month; this hints at higher consumer spending as well.

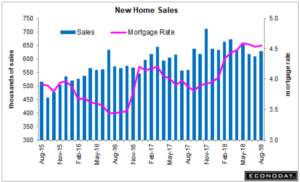

New Home Sales

At 629,000, August’s annualized sales pace for new homes came in at expected but was offset by sharp downward revisions to the two prior months totaling 39,00, July now 608,000 vs. an initial 627,000 and June now 618,000 vs. 638,000. The gain in August was boosted by discounting as the median fell 2.4% to $320,200. Discounting among home sales is evident in the year on year rate which is at plus 1.9% vs. a 12.7 percent rise in sales. Supply moved into the market, up 1.6% to 318,000 new homes for sale, but relative to sales little has changed, at an inventory level of 6.1 months vs 6.2 months. The downward revisions made to the previous months are a reminder of how volatile housing data can be. But with volatility aside, the sector is doing no better than mixed and looks to remain a disappointing contributor of overall economic growth. The jump in prices may prove a negative for upcoming sales.

FOMC Meeting Announcement

As anticipated the Federal Reserve increased its benchmark interest rate a quarter point in its latest September meeting. The Fed also upped its anticipation for economic growth for the rest of this year and next. Policymakers of the Federal Reserve Committee increased the fed funds rate 25 basis points to a range of 2- 2.25%; it was last at this range in April 2008. This eighth increase since the Fed began normalizing policy back in December of 2015. It held at rates near zero after the recession to speed up the economic activity. The Fed removed the language in its statement that had characterized its policy as “accommodative.” Fed Chairman, Jerome Powell said at the press conference that the Fed did not have a precise estimate of where accommodation ends. It still predicts three rate hikes next year. Short term interest rates are what is most affected by Fed decisions, rates on things such as credit cards should soon rise. While mortgage rates are still rising, the strong demand for housing has meant the impact of the Fed’s decision to increase rates has minimal impact. Savers should also see their interest rates increase, though banks tend to lift these slower than they do for borrowers. Powell, head chairman, stated “Our economy is strong, growth is running a healthy clip and unemployment is low, the number of people working steadily rising and wages are up. The Fed officials raised forecasts for gross domestic product next year by 0.1 percentage points to 2.5%. For the first time, the released a projection for growth in 2021 which they predict will stand at 1.8%. FOMC members forecast one more rate hike this year, most likely to take place in December, and three more in 2019.

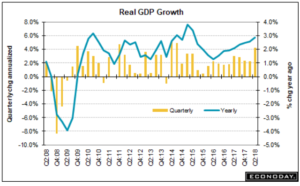

FOMC Projections

The Fed releases economic projections four times a year (March, June, September, and December or after every quarter. Fed officials estimate a gross domestic product to rise 3.1% in 2018, an upward revision from the 2.8% projection in June. The forecast for 2019 also increased moving 0.1 percentage points higher to 2.5%. The estimate for 2020 remained at 2 percent. Committee members for the first time released their 2021 projections, which predict the economy to grow at a rate of 1.8 percent, which aligns with the long-range forecast. The Fed predicts that the economy in 2021 will slow, for the first time. The confidence about how long the economy is expected to stay strong is beginning to wane. Forecasts for interest rates moves ahead remain unchanged from June, though the expectations for individual members showed a greater range of estimates. The committee still indicates there will be another rate hike before the end of 2018 and three more in 2019. One more is set for 2020, this would bring the median range to 3.4 percent where it is expected to stay through 2021 before settling to 3 percent over the long run.

Jerome Powell Press Conference

Jerome Powell, Fed Chair, stated in his press conference following the Federal Reserve meeting, repeated his comments made after the June meeting on the issue of tariffs: if the Trump administration’s policies end up in lower total tariffs this would be a positive for both the US and other countries. Yet if the tariff actions end up in more protectionism, he stated that would be unfavorable for everyone. Powell noted that businesses are voicing concerns over tariffs and the risk that they could result in inflation. In general, on the subject of inflation, the chairman stressed that the Fed is not seeing any significant pressures, that wage gains are modest and overall prices are steady and near the Fed’s 2 percent goal. In the press conference Powell cited high levels of business and consumer confidence, the Fed chair states that it is “a particularly bright moment” for the economy, though he did note talk of supply side constraints including labor shortages are not prominent risks quiet yet. On the administration’s fiscal stimulus, he stated the future effects are hard to predict but that if they do lead to greater business investment, this would likely increase the nation’s productivity in what would be a very welcome outcome. Yet he did also say there is “no hiding” from the unsustainability of the nation’s fiscal path which he largely attributed to health care expenses. When asked about emerging markets in other countries, he stressed that Fed policy is centered strongly on the health of the domestic economy, not foreign economies. Powell downplayed the importance that the accommodative

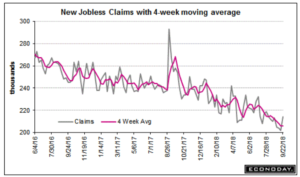

Weekly Jobless Claims

The number of Americans who applied for unemployment benefits late September rose to the highest level since early August. Initial claims, a rough estimate of layoffs, rose 12,000 to 214,000 in the week ending in September 22nd. Economists had predicted claims to climb to 216,000. The very low number of claims in the prior week could have been due partly because of Hurricane Florence. Officials couldn’t say definitively whether the rise in claims was a result of the storm. The monthly average of new claims rose 250 to 206,250. The number of people already collecting unemployment benefits rose 16,000 to 1.66 million; these claims are known as” continuing.” The number of layoffs in the US have been steadily declining this year, due to the strong economic growth and hiring that has recently occurred, this is putting them at the lowest level they have been in half a century. Some economists predict claims will drop below 200,000 for the first time since 1969. With unemployment at an 18-year low and likely to decline even lower, most companies are reluctant to fire anyone, afraid they will fail in finding replacements. Firms are already having a tough time filling the record number of job openings. Some are struggling to keep up with hirings demand for their goods and services. The four-week average is still below the 13 week average that is currently at 213,000 indicating labor market trends are still improving at a moderate pace.

GDP Revision

As anticipated the Federal Reserve increased its benchmark interest rate a quarter point in its latest September meeting. The Fed also upped its anticipation for economic growth for the rest of this year and next. Policymakers of the Federal Reserve Committee increased the fed funds rate 25 basis points to a range of 2- 2.25%; it was last at this range in April 2008. This eighth increase since the Fed began normalizing policy back in December of 2015. It held at rates near zero after the recession to speed up the economic activity. The Fed removed the language in its statement that had characterized its policy as “accommodative.” Fed Chairman, Jerome Powell said at the press conference that the Fed did not have a precise estimate of where accommodation ends. It still predicts three rate hikes next year. Short term interest rates are what is most affected by Fed decisions, rates on things such as credit cards should soon rise. While mortgage rates are still rising, the strong demand for housing has meant the impact of the Fed’s decision to increase rates has minimal impact. Savers should also see their interest rates increase, though banks tend to lift these slower than they do for borrowers. Powell, head chairman, stated “Our economy is strong, growth is running a healthy clip and unemployment is low, the number of people working steadily rising and wages are up. The Fed officials raised forecasts for gross domestic product next year by 0.1 percentage points to 2.5%. For the first time, the released a projection for growth in 2021 which they predict will stand at 1.8%. FOMC members forecast one more rate hike this year, most likely to take place in December, and three more in 2019.

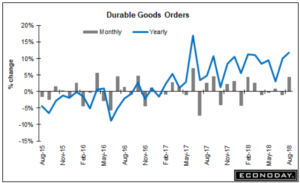

Durable Goods Orders/Core Capex Orders

Orders for durable goods rose 4.5% in August, on the back of orders for commercial aircraft and a surge in defense orders. This is the biggest increase since February, though the details within the report were softer. Economists forecasted a 2.2% increase in orders for durable goods or products made to last at least three years. Orders for July were revised to a 1.2% decline, up from the prior estimate of a drop of 1.7%. Without planes and cars, orders rose only 0.1% in August, this is much weaker than many economists predicted. Transportation often exaggerates the ups and downs in orders because of lumpy demand from one month to the next. Commercial aircraft orders rose 69% in August leading overall transportation orders o jump 13%. Orders for core capital goods, a rose only a slim 0.1% in the month, though defense capital good orders rose a large 44%. “In August, the details in the report were softer but this followed a host of very good results after a volatile autumn and winder and the overall trend remains solid,” stated Josh Shapiro, chief economist at MFR Inc.

Advance Trade In Goods

The US trade deficit in good in August widened to a seasonally adjusted $75.8 billion, according to the preliminary report of trading goods. Exports fell 1.6% while imports rose 0.7% in what looks to be the worst showing since February. Retail inventories rose 0.8% and wholesale inventories increased 0.7%. While the widening trade gap should reduce third quarter GDP, the increase in inventories may offset this, however. Foreign autos rose 3.2% in the month, but exports deteriorated in part because of China’s sudden resistance to US soybeans, as foods, feeds and beverages exports tumbled 9.5%. China has stopped buying soybeans in retaliation to the US tariffs against the second largest economy. There is good and bad news in trade, imports have been strong because the US economy has bee growing rapidly; tariffs, however, enacted by the White House against China and a host of aluminum and steel producers have raised the cost of doing business. Analysists calculated that the trade weighted effective US tariff rate has climbed 3% form 1.7% last year. Increasing tariffs further on China, as proposed, would take that rate to 6.2% and a 25% tariff on all autos would boost the US rate to 9.1%. A study from the Pew Research Center found that while 74% thought trade was good just 36% thought trade creates jobs and only 31% thought it increased wages. The US economy’s supply side does not have the slack needed to meet domestic demand pumped up by the tax cuts and government spending increases. The deficit has further to rise, believes Ian Shepherdson, chief economist at Patheon Macroeconomics.

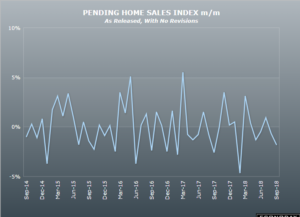

Pending Home Sales

US pending home sales sank 1.8% in August, according to the index the National Association of Realtors. This index, which tracks real estate transactions in which a contract has been signed but the transaction hasn’t yet closed, this is lower than its year ago levels for the eight month in a row in August, this time by 2.3%. August marked the fourth straight monthly decline as well. Economists had forecasted an unchanged reading in pending home sales. There still aren’t enough homes to buy, and what’s left over is too pricey and picked over to tempt most buyers. Rising mortgages rates won’t lead to a significant decline, but with little momentum in the market. Pending sales lead actual closings by six weeks. One report after another confirms that energy in the housing market is fizzling out. Earlier this month, the Realtor industry group reported that sales of existing were unchanged in August compared to July, a welcome relief after multiple months of declines. The pace of price gains also moderated but remains optimistic that more inventory will help perk up sales next year.

Personal Income/Consumer Consumption/ Core Inflation

The consumer spending survey moderated in August after five straight strong gains. Consumer spending rose 0.3%, the slowest pace since February. Economists had predicted an increase of 0.4%. The 12 month increase in the PCE index, the Fed’s preferred inflation gauge, fell to 2.2% from 2.3%. The yearly increase in the core PCE rate that doesn’t count food and energy was steady at a 2% rate. Outlays on durable goods such as new cars fell 0.1%, while spending on services increased 0.3%, and purchases of non-durable goods such as gas rose 0.5%. Meanwhile, personal income also rose 0.3% last month. Economists had forecast a 0.4% rise. Wages rose 0.5% in August, the fastest pace since January. The savings rate held steady 6.6%. The savings rate had been as high as 7.4% earlier this year. Economists expect consumer spending to moderate in the third quarter, after a 3.8% gain in the second quarter. Still, consumer spending is expected to remain strong with confidence at high levels, taxes cut and income rising. Americans are more confident about the economy than they have been in 18 years. “Both overall core inflation is right near the Federal Reserve’s 2% objective and show no sings of accelerating. The recently implemented tariffs on $200 billion of Chinese made goods could temporarily add to inflation in the next few months but should not lead to a long run acceleration in inflation,” stated Gus Faucher, chief economists at PNC Financial Services Group. This data indicates a solid but slowing momentum in consumer spending growth in quarter three, around 3.5% after an impressive 3.85% in the second quarter. GDP points to growth around 3.3% in the third quarter.

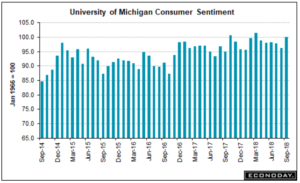

Consumer Sentiment

The final reading of the consumer sentiment index put out by the University of Michigan in September was 100.1, above August’s level of 96.2. The preliminary reading was slightly higher at 100.8. This is only the third time the index has exceeded 100.0. Readings of current economic conditions and the consumer expectations were slightly down from preliminary readings but up sharply from August. Expectations for improved personal finances are at the highest level since 2004. Inflation expectations have also declined. The only negative for the future is the concern about trade tariffs. The economy was referred to as “strong” and growth running at a healthy pace said Fed Reserve Chairman Jerome Powell after the latest FOMC meeting. It is clear that consumer are feeling upbeat.