15 Oct CCL Market Update: Producer Price Index, Mortgage Applications, Weekly Jobless Claims, Consumer Price Index/Core CPI, and More…

Producer Price Index

The wholesale cost of US goods and services snapped back in September, the level of inflationary pressure however has appeared to have eased, temporarily at the very least. The producer price index climbed up 0.2% in the last month, springing back from the first decline in half a year. The increase matched economists expectations. The increase in wholesale inflation over the past year has slowed again to 2.6% from 2.8%. The 12 month rate hit a seven year high of 3.4% just four months ago. Transport prices surged 1.8 percent in the month with its yearly rate showing clear pressure at 5.9 percent. The lack of capacity in the shipping sector, including lack of trucks and especially lack of truck drivers continues to be a serious constraint in 2018. Other than these factors the data once again appeared subdued. The cost of partly finished and raw materials was also muted, suggesting a big move that can happen in either direction in wholesale inflation, however this will likely not happen too soon. The cost of services rose 0.3%, but mostly in parts of the economy that are hard to measure, and they are prone to sharp swings. Wholesale cost of airline flights, for example, posted the biggest advance since records began being kept in 2009. While the increase likely reflects the higher fuel costs, passengers are almost certain the they see such a large price hike on plane tickets. The wholesale of goods, meanwhile, fell by 0.1%. Good and gasoline prices both declined, though the drop-in fuel will not likely last. Stripping out food, energy and trade margins, or “core PPI” rate of wholesale inflation surged 0.4%., the 12 month core inflation rate remained flat at 2.9% which is still considered an elevate level. Wholesale inflation has shot up from near zero a few years ago to a yearly rate of almost 3% now, reflecting a broad upsurge in prices tied to the surging US economy. The question is whether inflation will continue to rise. Wholesale costs lately have begun to taper off, but higher gas prices are likely to prevent it from dropping much further. US tariffs on steel and other foreign goods and the retaliatory sanctions by other nations have also raise the cost of other goods critical to the economy. Still, the Federal Reserve is sticking to its forecast that overall inflation will remain around its target 2%, allowing it to carry on with its current strategy of gradually raising US interest rates. “The latest inflation data corroborates our view that the Feds is likely to move ahead with another rate hike in December, bringing this year’s total to four,” economists at Oxford Economics wrote.

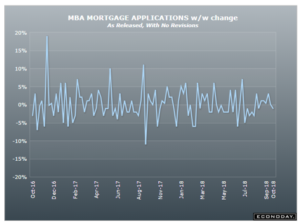

Mortgage Applications

Purchase applications for home mortgages fell a seasonally adjusted 1 percent in the week of October 5th. The year on year unadjusted gain was also down 1 percentage point to 2 percent. Applications for refinancing decreased by 3 percent from the week prior, with the refinancing share of mortgage activity falling 0.4 percentage points to 39.0 percent. The average interest rate rose 9 basis points from the prior week to 5.05%, the highest level since February 2011.

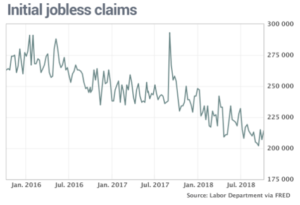

Weekly Jobless Claims

The monthly average of new claims increased by 2,500 to a level of 209,500, this is only marginally higher than the month ago comparison. During the week of October 6th claims were up 7,000 to 214,000. The number of people already collecting unemployment benefits or “continuing” claims are near a 45 year low but edged up by 4,000 to 1.66 million. The low level of layoffs reflects the tightest labor market in half a century. Job openings are at a record high and unemployment is at a 48 year low of 3.7%.

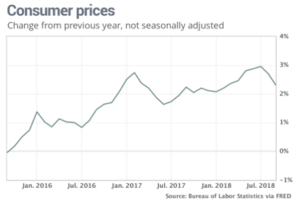

Consumer Price Index/Core CPI

The higher cost of renting and owning a whom nudged consumer prices higher in September, but inflation more broadly eased again after a recent runup. The consumer price index rose 0.1% in September for the sixth increase in a row. Economists had predicted a slightly higher 0.2% increase. The increase in the cost of living over the past 12 months slowed again to 2.3% from 2.7%. Two months ago, the yearly rate hit a six year high of 2.9%. The more closely followed measure known as the core inflation rate which excludes food and energy, rose 0.1% last month. The yearly increase in the core inflation, however, was flat at 2.2%. The government predicted Social Security Benefits will rise 2.8% in 2019 based on inflation figures derived from the latest report. About half of the increases in the consumer price index last month were tied to higher rents and the cost of home ownership. The cost of clothing increased for the first time in four months and medical cost rose for the first time in three months. Prices for airline tickets and auto insurance also increased. Although gasoline prices actually rose last month, they did not increase as much as they normally do in the month of September. The seasonal adjustments resulted in gas prices showing a decline. Food prices were unchanged while the cost of used vehicles fell sharply. In some good news for workers, after adjusting for inflation, hourly wages rose a solid 0.3% in September and are up 0.5% in the past year. The US economy is arguably the strongest it’s been in two decades with job openings at a record high and unemployment at a 48 year low. Strong growth and a tight job market has produced higher inflation, forcing the Federal Reserve to raise interest rates. Rates are still historically low, inflation is still relatively benign, and the economy has plenty of momentum to keep growing solidly at least through the end of the year.

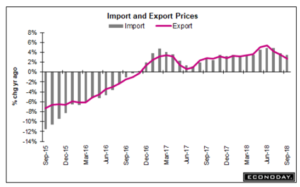

Import and Export Prices

The headline for September was at plus 0.5 percent with the import prices appearing to show pressure but the details within the report do not. When excluding a 4.1 percent monthly upswing in prices of imported petroleum, import prices come in unchanged. The strength of the dollar together with discounting by foreign sellers are keeping prices of finished goods flat, unchanged in the month for both vehicles and capital goods and down 0.1 percent for consumer goods. Year on year rates underscore the lack of imported price pressure, unchanged by capital goods, up 0.1 percent for vehicles and up 0.6 percent for consumer goods. Total year on year import prices, inflated by a 32 percent jump in petroleum, are up 3.5 percent. Without petroleum, import prices are up only 0.6 percent on the year. One of the few areas to show any upward pressures is the prices of imported foods which jumped 2.0 percent in September. The export side shows a contrast with agricultural prices down 1.4 percent in the month. Total export prices were unchanged in the month for a yearly 2.7 percent rate in contrast to agricultural prices which are down 2.3 percent. Export prices of finished goods match those on the import side, all flat. Cross-border price inflation, outside of the monthly ups and downs for oil, remain subdued and with import prices, because of the strength of the dollar.

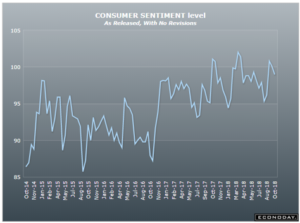

Consumer Sentiment Index

Consumer sentiment moved slightly lower this month due to less favorable views of personal finances. It still remains at a very solid 99.0 I the preliminary October reading vs. 100.1 in the final September reading and 100.8 in the preliminary. Year ahead inflation expectations are edging higher this month, up 1 tenth to 2.8 percent. But an offset to this report is 2 tenths decline in the 5-year inflation expectations now down to 2.3 percent. A side not going into the mid term elections next month is the confidence I the government’s economic policies is at its highest level in 15 years reflecting strong confidence among Republicans and improving confidence among Democrats. Among other readings, the current conditions component edged 8 tenths lower from the final September reading to 114.4 while the expectations component fell 1.4 points to 89.1.