10 Sep ISM Manufacturing Index, Construction Spending, Motor Vehicle Sales, Trade Deficit, ADP Employment, Weekly Jobless Claims, and more…

ISM Manufacturing Index

Business conditions surged in August to a 14-year high as American manufacturers continue their success. The manufacturing index jumped to a 14 year high of 61.3% last month from 58.1% in July. Economists had predicted the index to total 57.9%. Readings over 50% indicate more companies are expanding rather than shrinking. The ISM new order index climbed 3.2 points to 65.1% and the employment gauge rose 2 points to 58.5%. 16 of the 18 industries tracked by the ISM index reported expansion in August. The ISM index is compiled from a survey of executives who order raw materials and other supplies for their companies, this gauge tends to rise or fall in relationship with the health of the economy. Growth in the US economy exploded in the spring and the third quarter that got underway in July is also shaping up to be a good one. Prices for raw materials are also on the higher side, though inflationary pressures have eased a bit lately. Demand remains quite strong, but with rising inflation and trade related uncertainties are pressuring margins and causing business to plan cautiously for the year ahead. Business continues to be strong and it is anticipated that growth will continue in the next few months.

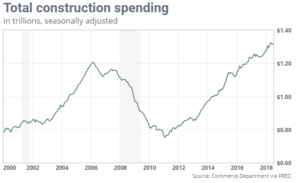

Construction Spending

Construction expenditures were 0.1% higher in July than in June, with the public sector leading, increasing 0.7% in the month. Spending on private construction ticked down 0.1% for the month. Residential construction increased 0.6% compared toe month prior and was 6.6% higher than a year ago. The July figure missed economists’ forecasts of a 0.4% monthly increase. The government’s construction spending data is choppy, but the overarching trend is up. Through the first seven months of the year expenditures were 5.2% higher than in the same period last year, 2017.

Motor Vehicle Sales

Most major auto makers reported increases in US sales in August, though analysts expect vehicle demand to cool for the remainder of 2018 amid higher interest rates and rising vehicle prices. Overall US auto sales were expected to rise slightly in August as customers take advantage of Labor Day discounts against a backdrop of a healthy US economy. The industry is expected to show a 1% increase in sales for August when full results are tallied. The year over year comparison will benefit from the weak sales seen in August 2017, when Hurricane Harvey forced the closures of hundreds of dealerships, denting the national total. Sales are expected to cool in coming months with factors such as rising interest rates, higher vehicle prices, and the threat of tariffs on automotive imports prompting customers to consider buying a used car or delay a vehicle purchase altogether.

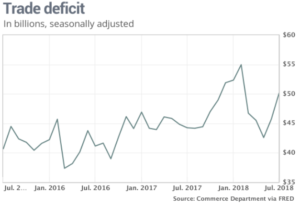

Trade Deficit

The trade deficit soared almost 10% in July after record imports and hit the highest level in five months keeping the US on pace to record the largest annual gap in a decade. The deficit climbed to $50.1 billion from a revised $45.7 billion in June, economists had forecasted a $50.4 billion gap. The US trade deficit added up to almost $338 billion in the first seven months of 2018. This compared to the $316 billion deficit in the same span of last year, 2017. Imports rose 0.9% to a record $261.2 billion in July. US imports have surged in 2018 largely in part of rising demand for oil and higher prices for petroleum, but Americans have also bought more foreign autos, computers, and pharmaceutical drugs. Exports fell 1% to $211.1 billion, though they are also near a record high. In July the US exported far fewer passenger planes and soybeans. Soybean exports are still up sharply from a year ago. Many foreign buyers sought to lock in prices and beat the pending US and retaliatory foreign tariffs by obtaining them earlier. Soybean exports have totaled $18.8 billion through the first seven months of 2018 a 43% increase from $13.1 billion last year in the same period. Exports of domestically supplied petroleum set a record in July even though the US still imports huge amounts of foreign oil. The US has returned to being one of the world’s largest producers after a long hiatus due to a fracking revolution that’s unlocked previously unreachable fuel stores in large inland shale deposits. Imports of foreign steel and aluminum are still higher compared to a year ago despite the recently imposed tariffs by the president, Trump. The US is growing rapidly despite the rising trade deficit, reflecting broad strength in the key segments of the economy. Gross domestic product expanded by 4.2% in the spring and is forecasted to grow at a 3% rate in the third quarter. So far the impositions of the US tariffs on a variety of foreign goods have done nothing to curb the deficit. The July goods deficit with China leaped to a record high of nearly $37 billion. One reason this deficit continues to rise is its counter intuitive: Americans are financially better off than consumers in most other countries. They can afford to spend more on imports such as French wine and German autos. A stronger dollar is also making imports less expensive to buy. Yet if the trade deficit continues to rise it’s likely to weigh down on GDP, the official sign of growth of the US economy.

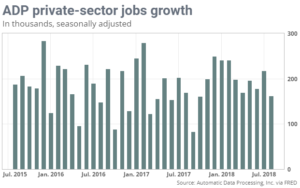

ADP Employment

The US seasonally adjusted private job sector in August was at a level of 163,000, down from 217,000 in July. This is the smallest growth since October. Economists polled expected 182,000 new jobs; as July’s numbers were revised 2,000 lower. Midsized companies led the way adding 111,000 new jobs. By sector, professional and business added 38,000 jobs, education and health added 31,000 positions and leisure and hospitality added 25,000. The natural resources and mining sector lost 1,000 jobs. Before this report, economists polled had expected the Labor Department to report a 200,000 gain in nonfarm jobs in the upcoming jobs report. Although we did see a small slowdown in job growth the market remains very divers, as midsized businesses continue to help growth, adding nearly 70% of all jobs this month and remains resilient in the current economic climate. Considering how low the jobless rate is, this represents reasonably solid pace of employment growth. Jobs growth has remained strong and in turn consumer confidence has also remained strong, the unemployment rate is at nearly a two decade low. With more job openings than people looking for them, the labor market is set to remain on the tighter side for some time. The only issue is with the mediocre growth in average wages, suggesting companies do not feel the need to compete for labor.

Weekly Jobless Claims

Initial jobless claims or the rate of layoffs in the US fell by 10,000 to 203,000 in the week prior to the Labor Day holiday, reaching the lowest mark since the end of 1969. Economists had forecasted a reading of 212,000. The monthly average of new claims declined by 2,750 to 209,500. Both the weekly and monthly averages hit the lowest levels since December 6, 1969. The number of people already collecting unemployment benefits, or “continuing” claims fell by 3,0000 to 1.71 million. Layoffs have been declining since 2010 and are now at the lowest level in almost 50 years. Soon jobless claims could possibly dip below 200,000 predict some economists. The rate of layoffs has already fallen to record lows in many states and others could join their ranks soon. The fewest amount of new claims on record was set in November 1968 at a record low of 162,000. The working population, however, was much smaller then and the economy was also quite different. Companies have created more than 19 million new jobs in the past eight years to drive the unemployment rate down to 3.9% from a peak of 10%. Companies are struggling to find skilled workers and the yare reluctant to lay off anyone.

Productivity/Unit Costs

The growth in US productivity in the second quarter was left unchanged at 2.9% after the government’s latest revision. Output grew 5% instead of the previously reported 4.8%. The increase in hours worked was raised to 2% from 1.9%. Unit labor costs fell a revised 1%, a touch higher than the initially reported 0.9% decline. The most notable change was in the manufacturing sector, whose productivity growth was revised up to 1.5% from 0.9%. The increase in US productivity in the second quarter was the largest over three years. Economists are waiting to see if the tax cuts encourage businesses to invest more and help speed up productivity, the key to a higher standard of living for Americans.

ISM Nonmanufacturing Index

A survey of the non service oriented companies of the US which includes: hospitals, retailers, and restaurants show rapid growth in the month of August, underscoring the broad strength in the economy. The Institute for Supply Management said is non manufacturing index climbed to 58.5% in August from 55.7% in the month prior, bringing the index back near post recession highs. Numbers over 50% in the index are viewed as positive for the economy and anything over 55% is considered exceptional. New orders, production and employment all increased in August. All but one of the 17 industries tracked by ISM reported stronger business last month. However, this is not stopping the rapidly growing companies and managing the declines well enough to keep business growing strong. The US economy itself is also expanding rapidly and could post its fastest growth in 2018 in 3 years. Based on current trends on customer requests and conversions to orders, we are trending for this month to be the best August in history. Tariff related cost increases are beginning to accelerate, whether tariffs have been put into effect or not.

Factory Orders

Factory orders declined 0.8% in July, this decline coming after two monthly gains and a touch worse than the 0.6% decline that economists had predicted as it fell 1.7%. June’s order growth was downwardly revised a tenth down to 0.6%. The inventories to shipments ratio was also up from June’s 1.34 to a level of 1.35 in July.

Nonfarm Payrolls/ Unemployment Rate/ Average Hourly Earnings

The United States created 201,000 new jobs in August, keeping the unemployment rate at an 18 year low and generating the fastest increase in worker pay since the end of the Great Recession. Economists had forecasted a 200,000 increase in new nonfarm jobs. The unemployment rate was unchanged at 3.9%. The increase in hirings in August was another solid gain that reflects the broad strength of the economy that accelerated in the spring and showed little sign of slowing down toward the end of summer. The biggest news in the August employment report was a sharp increase in pay. The average wage paid to American workers rose by 10 cents to $27.16 an hour. Even more, the yearly rate of pay increases climbed 2.9% from 2.7% marking the highest level since June of 2009. White collar professional firms filled 53,000 positions, bringing the total created over the past 12 months to more than half a million. These are the fastest growing jobs in the country. Health care providers hired 33,000, transport firms added 20,000 jobs and construction companies hired 23,000 workers. Employment fell by 3,0000 in manufacturing for the first decline in 13 months. US tariffs and a scarcity of skilled laborers may finally be taking their toll. Retail jobs were also cut. Employment gains for July and June, were revised down by a combine 50,000. Still, the economy managed to produce an average of 207,000 new jobs a month so far this year, a pace faster than hirings in both 2017 and 2016. The economy surged in the spring and is still growing at a rapid pace as we approach fall. Most companies are hiring and layoffs have tumbled to a nearly 50 year low. Aside from the shortage of skilled labor, companies say their biggest problem is comping with the higher US and foreign tariffs that have in effect raised the cost of key materials such as steel and lumber making it harder to obtain these supplies. The Federal Reserve is also expected to increase US interest rates again at their meeting taking place at the end of September, especially in light of the rising wages in the August employment report. The higher pay could put more upward pressure on rising inflation. Interest rates are still low enough that it has not bothered businesses all too much. The central bank had adopted a gradualist approach because inflation is still relatively mild by historical standards. Consumers are feeling more of the brunt of inflation as most if not all of the increase in pay over the past year has been eaten up by the higher inflation. The cost of living as measured by the consumer price index has also climbed 2.9% in the past year. The strong economy is finally translating into wage gains for more workers. As of right now, the US economy broadly6 remains on a solid growth path, labor market included. As long as businesses remain upbeat in their outlook, hiring and the labor markets should continue to remain and strong and the economy should follow suit.