17 Sep CCL Market Update: Consumer Credit, NFIB Small Business Index, Job Openings, Producer Price Index, and More…

Consumer Credit

Consumer borrowing picked up in July, total consumer credit rose $16.6 billion in July to a seasonally adjusted $3.91 trillion. That is an annual growth rate of 5.1%. Economists had been expecting a $13.9 billion gain. Credit rose a revised $8.5 billion in June, down from the prior estimate of $10.2 billion. Revolving credit, such as credit cards rose only slightly in July, up 1.5% reversing Junes drop of 1.4%. Nonrevolving credit, such as auto and student loans, jumped 6.4% in July after a 4% gain in the prior month. This the largest increase in eight months. The report does not include mortgage debt. Consumer credit had big gains around the holidays and in May, but overall has been on a slight downward trend. This raises concerns of whether spending will continue to power growth in the quarters to come. In the second quarter of the year, April-June, consumer spending jumped 3.8% partly due to Trump tax cuts. Stronger wage growth which was seen in the August job report may help spending as banks are tightening standards on credit cards to borrowers with low credit scores. Consumers still appear to have some degree in caution in the spending. They are living within their means. Consumers are leading the expansion and are doing it not just entirely on credit.

NFIB Small-Business Index

Small business sentiment climbed to a new record in August., the index rose 0.9 points to a seasonally adjusted level of 108.8, with advances in six of the ten major components. The previous record high was set 35 years ago! The biggest gain came in plans to increase inventories; the highest level of the components is job openings which reported a net 38% improvement. Job creation plans and unfilled job openings both set new records. The percentage of small business owners saying it is a good time to expand tied the May 2018 all time high and inventory investment plans were the strongest since 2005 and capital spending plans the highest since 2007.

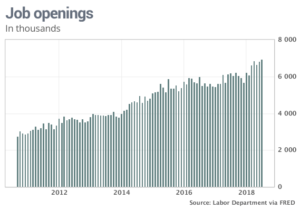

Job Openings

The number of job openings in the US climbed to a record 6.94 million in July in a clear sign that the booming economy is entering the second half of the year with lots of momentum. Job openings rose from their June level of 6.82 million. About 5.68 million people were hired and 5.53 million lost their jobs in July. The share of people who left jobs on their own or the quits rate, rose a notch to a 2.7% among private sector employees. The record was set in 2001 when it reached a level of 2.9%. The quits rate was 2.4% among all workers also near the record high. Workers who switch jobs usually get better pay than those who remain in their old ones and more people switch when they are confident about the economy. Retailers unlike most other industries employment was cut by 85,000, reflecting the ongoing struggles in the retail sector as shopping shifts heavily toward the internet. Job openings for education and government also declined; while job openings increased the most in insurance, finance and manufacturing. The US economy is booming, growth surged in the spring has carried through to the summer. Unemployment is low at 3.9% and layoffs are at a 50 year low. Some workers are taking advantage of the strong economy and tight labor market by switching jobs in search of better pay. As a result, companies are offering more attractive pay and benefits to0 both lure new workers and retain old ones.

Producer Price Index

The wholesale cost of US goods and services fell in August for the first time in a year and a half as the recent upturn in inflation appeared to ease, at least temporarily. The producer price index declined by 0.1% from the month prior, while economists had forecasted a 0.2% increase. The drop 9in wholesale prices was the first since February 2017. The decline was tied to lower margins for services such as retail and transportation. The increase in wholesale inflation over the past year also fell to +2.8% from 3.3%, in perhaps a better indication that upward pressure on prices may be leveling off. The yearly rate had hit a seven year high two months ago. The cost of partly finished and raw materials also eased again in August. The cost of services fell by 0.1% and accounted for the decline in overall wholesale inflation. The price of goods was unchanged. A 0.4% increase in the wholesale cost of gasoline and other forms of energy was offset by a 0.6% decline in food prices. Core wholesale inflation rose 0.1% in August. The core rate strips out the volatile components such as food, energy and trade margins. The 12 month rate edged up to 2.9% to match the 2018 high. Economists are split on the direction of inflation. Some brush off the recent decline in wholesale prices and expect inflation to edge higher in the coming months while others believe inflation will continue to moderate but remain elevated.

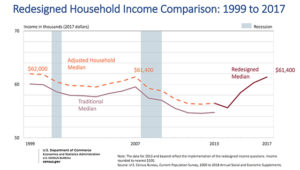

Median Household Income

For the third straight year real median income rose climbing 1.8% to $61,372 in 2017. Due to calculations the level is statistically tied with 1999 and 2007. In other words, household income has come back from its losses during the recession that began at the end of 2007. The amount of people in poverty decreased to 12.3% from 12.7%. While people without health insurance stayed at 8.8%. More Americans were back to work full time; male workers rose 1.4 million while female workers rose 1 million. More workers median pay fell to 1.1%, suggesting that new hires are for lower paying jobs. The real median earnings of male workers rose 3% while females did not see much of a change. The female to male earnings ratio was 80.5%, not statistically different. As the labor market improved so did poverty numbers; with the exception of those with at least a bachelor’s degree, the group with the least amount of change rose only 0.3 percentage points to 4.8%. This is the second longest economic expansion since World War II, 39.7 million are still in poverty. The economy continues to improve gradually from the recession and financial crisis. In the beginning of the recovery economic gains were primarily for higher income households, but these gains have broadened, and more households are seeing the benefits. 2017 brought the firmest growth in average income to households in the 40th to 80th percentile group.

Beige Book

Three of the Fed’s twelve districts reported weaker growth in August; while the overall economy expanded at a moderate pace. Trade concerns and lack of workers delayed projects. There was also a deceleration in prices of final goods and services. Shortages of workers and possible trade tariffs continued to be the biggest worries for businesses. Wage growth remained modest to moderate as firms tried to attract employees. Concerns of trade over summer has now moved into a scale back or postpone of capital investments. Businesses were trying to pass along cost hikes to customers, but input costs were still rising more than selling prices as a few districts represented increased inflation expectations. However, economists say there is no danger of the economy overheating. Short term interest rates are expected to increase at the next, end of September meeting. Unemployment and inflation remain near 2% target as most economists predict the Fed to stick to gradual rate hikes until mid next year.

Weekly Jobless Claims

The rate of layoffs in the US fell slightly in the early weeks of September, and clung to a 49 year low, underscoring the strength of the economy and the best labor market since the turn of the century. Initial jobless claims slipped 1,000 to 204,0000 in the week ending in September 8th. Economists had forecasted a reading of 210,000. The monthly average of new claims slipped 2,000 to 208,000. Both weekly and monthly averages were at the lowest level since December 1969. Continuing claims declined by 15,000 to 1.7 million, the lowest level since 1973. Layoffs have been falling steadily for eight years as they could soon drop below 200,000 for the first time since the 1960’s. Job openings have climbed to a record level of 6.9 million. Hirings remain robust even with unemployment at the 18 year low of 3.9%. Many economists believe jobless rates will head toward 3.5% giving employees even more bargaining power. Wages are on the rise as well as the willingness to switch jobs for even more money earnings. Rising wages are contributing to worries of higher inflation; as the Fed is prepared to increase interest rates again later in the month.

Consumer Price Index/ Core CPI

Americans paid more for gas, rent and airfare in August but upward pressure in consumer inflation eased for the first time in almost a year. The consumer price index rose 0.2% in August marking the fifth straight monthly increase; economists predicted a 0.3% gain. The increase in costs of living over the past 12 months slowed to 2.7% from its 6 year high of 2.9% for the first drop since last fall. Stripping out food and energy also known as core inflation edged up 0.1% in the last month. The cost of energy, mainly gasoline, rose 1.9% last month after declining in both June and July. Gas and rent accounted for the most increase in CPI last month. Americans paid less for medical care, telecommunications and clothing. The increase in inflation over the past year has mostly offset the rising wages. Ager adjusting for inflation, hourly wages rose only 0.1% in August and are up just 0.2% over the past year. The Central Bank is widely expected to raise interest rates at the end of the month meeting and once more before the year end.

Retail Sales

US retailers in August registered the weakest sales in six months and only an increase in purchases at gas stations prevented a decline. Retail sales rose only 0.1% in August. Economists had forecasted a 0.3% increase. The numbers would have been worse if not for the 1.7% spike in spending at gas stations. Retail sales without car fuels fell 0.1%., total retail sales increased 0.7%. Receipts fell 0.8% at auto dealers that that weighed heavily on overall sales since they account for about 20% of retail spending. Aside from gas stations, internet retailers were the only other standouts, sales rose 0.7%. Even after the slowdown in August retail sales are still rapidly growing, they have climbed 6.6% in the last 12 months. Savings rate was fairly high at 7%.

Industrial Production

Industrial production rose 0.4% in August for the third monthly increase and was well above Wall Street expectations of a0.3% increase. Over the past year output is up 4.9%. In August, manufacturing rose 0.2% on the back of a 4% rise in production of motor vehicles and parts. Excluding autos, manufacturing was flat in August. Overall gains in output were widespread with only nonindustrial supply production declining. Utility output rose 1.2% after a 0.1% gain in July. Capacity utilization rose to 78.1% in August, the highest rate since April. The capacity utilization rate reflects the limits to operating the nation’s factories, mines, and utilities. It still remains below prerecession levels above 80% that could fan production costs and prices. Manufacturing activity remains strong despite rising trade tensions. Some economists are worried the stronger dollar may soon curb exports, while other argue President Trump’s protectionist policies are actually helping US manufacturers.

Consumer Sentiment

The confidence of Americans in the US economy and their own well-being rose toward the end of summer and stood near a 14-year high. The consumer sentiment index put out by the University of Michigan’s consumer sentiment index rose to 100.78 in September from 96.2 based on a preliminary reading. It’s the second highest mark since 2004, trailing only the results from this past March. Sentiment might even have set a new post recession high if it wasn’t for lingering worries over the prospect of a trade war. Consumers were more optimistic about getting a job or keeping the one they have. They even think they’ll earn more pay and were less worried about inflation. Notable, confidence increase among virtually every socio-economic group of Americans.