This is the most common option for borrowers who have a conventional loan, and the most encouraged option by lenders because it is the most affordable.

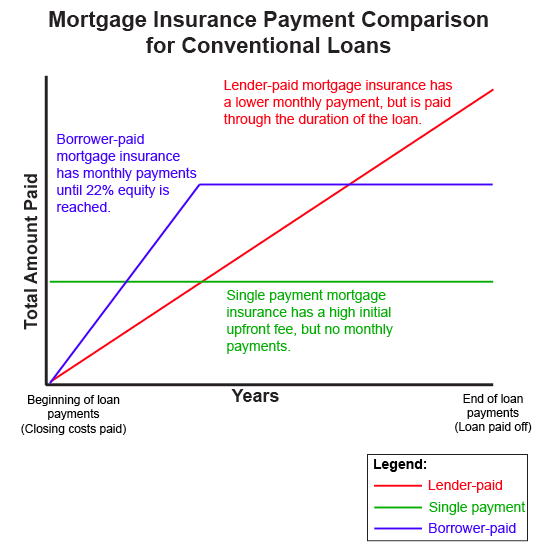

Borrower-paid mortgage insurance has no upfront costs, and is simply an additional monthly payment on your loan that ends once you have 22% equity in your home (78% loan to value). You can also challenge mortgage insurance once you reach 20% equity, and potentially get rid of this additional charge early.

Borrower-paid is ideal because it offers borrowers a manageable monthly payment that gets paid off in a reasonable amount of time. Another advantage of borrower-paid, especially in a rising interest rate environment, is that mortgage insurance will eventually go away, and you’ll be left with your low mortgage interest rate.